NJ tax revenues are up … Murphy still wants tax hike on rich

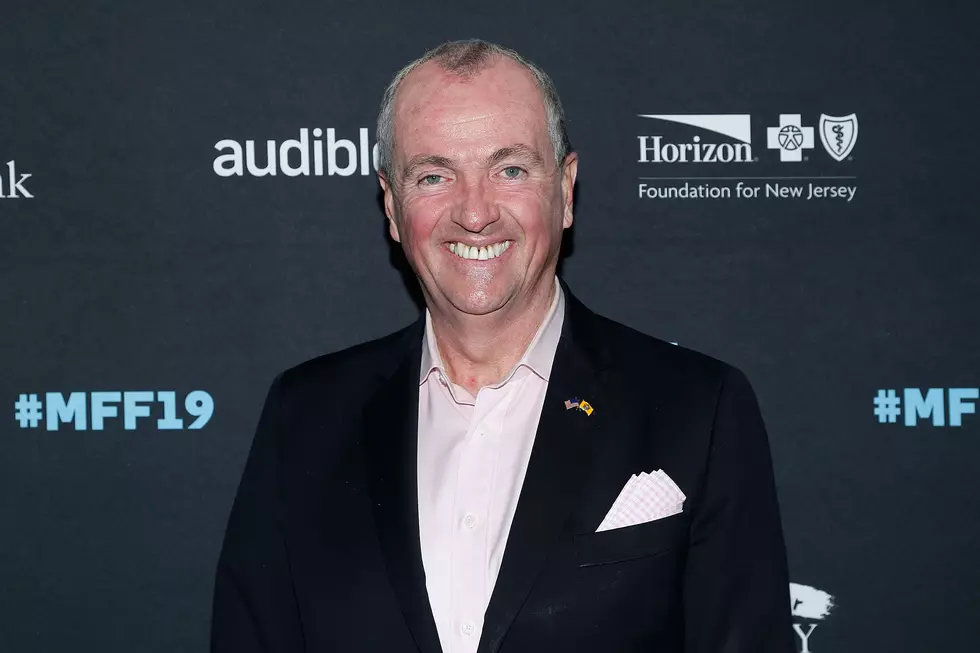

EWING — Gov. Phil Murphy says tax revenues are coming in higher than expected and is proposing property tax relief if lawmakers pass a an income tax increase on millionaires.

Murphy, a Democrat, says he would put $250 million toward property tax relief if the Democrat-led Legislature approves his proposal to raise income tax rates on people making more than $1 million.

“If we get the millionaires tax, we will plough at least $250 million more than what I’ve already talked about into direct middle class property tax relief," Murphy said.

Murphy didn't say exactly how he would help residents paying property taxes, which are levied at the local level. He spoke Monday at a town hall meeting.

Homestead benefits once exceeded $2.2 billion, but state spending on them has shrunk below $300 million. People lose eligibility as their incomes rise beyond the program’s $75,000 limit.

The 'Senior Freeze' property tax reimbursements, which are available to longtime homeowners who are at least 65 years old, have similarly barred people from entering the program because the income eligibility threshold has been stagnant.

Lawmakers are currently weighing Murphy's $38.6 billion budget proposal. A balanced budget must be enacted by July 1.

State Treasurer Elizabeth Muoio is expected to brief lawmakers on revenue next week. Murphy didn't provide details about their performance. Projections for tax collections had been scaled back in February after results fell behind expectations in the winter, though administration officials said changes in taxpayer behavior could level out in April.

“Looks like we’re actually taking in somewhat more revenue right now in tax season than we thought we would, which is a pleasant surprise," Murphy said.

Murphy has long called for raising rates on the wealthy. Senate President Steve Sweeney has resisted, citing the impact of federal tax changes that limit how much in state taxes residents can use as a federal tax deduction.

(Copyright 2019 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.)

More from WOBM:

More From 92.7 WOBM