Was your car flooded? Here are your options in New Jersey

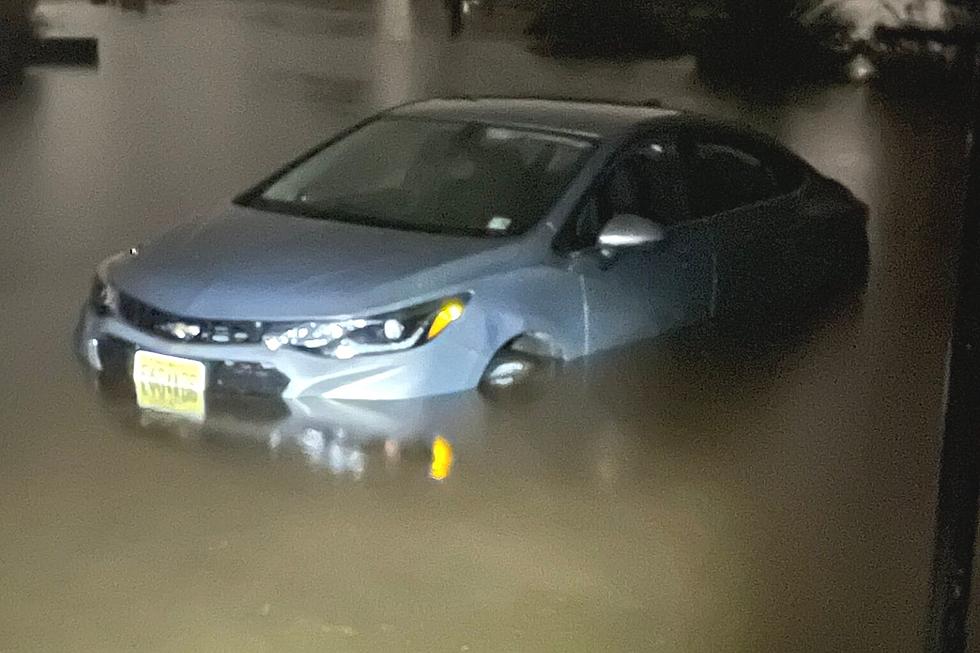

The remnants of Hurricane Ida turned countless New Jersey streets into rapids late Wednesday, consuming automobiles in some spots and forcing drivers into treacherous situations that may have claimed their vehicles for good.

Much of the damage occurred in areas that aren't exactly known for being prone to floods. Experts predict that folks throughout New Jersey will have plenty of questions now that their vehicles went for a swim — for a few minutes or several hours.

"You do not file a homeowner's claim for your car," Christine O'Brien, president of the Insurance Council of New Jersey, advised residents. "Regardless of where your car is housed during a flood or water event, your auto insurance pays for all things related to your vehicle."

Are you covered?

Coverage for flood damage isn't an automatic with a standard policy — it's an add-on, better known as comprehensive coverage. But, according to O'Brien, most folks who are still paying off their vehicles — whether they know it or not — have both collision and comprehensive coverage on the books.

"Most financing plans require that you have collision and comprehensive on your policy," she said.

People that own older cars or have no payments left on their vehicles, though, may not be as lucky.

"They may not opt to buy comprehensive and collision coverage because they can save on their premiums," O'Brien said.

O'Brien said anyone who suffered damage as a result of flood waters, and has coverage, should first call their insurance company so an adjuster can check out the damage directly, either through photos or by coming out to see the vehicle.

Your insurance carrier can declare your vehicle to be a total loss, meaning the value of necessary repairs outweighs the value of the vehicle, or the carrier could declare the car as repairable and would issue a settlement claim check to the owner to get the process going.

A policyholder, O'Brien noted, does have the option to try to repair their vehicle that's been declared as a loss. But that decision comes with risk, and likely a lower settlement amount, she said.

What's the damage?

Richard Kahl, owner of Rich's Automotive in Brick, has seen quite a few flood-damaged vehicles in his 17 years at the shop. Superstorm Sandy in 2012 gave him all the knowledge he needs about the damage caused to a vehicle when it's submerged in water, even for a short amount of time.

"I've seen it where they suck up water through an air cleaner and it bends connecting rods ... and it gets down in the engine and hydrolocks the engine," Kahl told New Jersey 101.5.

Newer vehicles, Kahl added, are more susceptible to instant issues, due to the advanced electronic equipment that's located close to the ground.

"The water destroys the networking," he said. "With Sandy, when it was salt water in there, it just damaged harnesses and damaged computers, and you'll get green junk inside all the connectors, and there's really no fix."

According to AAA, motorists should not attempt to start their vehicle after it has been parked in a flood or was driven through floodwaters.

First Responders Appreciation

More From 92.7 WOBM