Poll: NJ homebuyers unfazed by market dip, hesitant to compromise

The Federal Reserve's half-point interest rate hike announced last week was designed to curb inflation but could have an impact on a pandemic-long winning streak for the U.S. housing market.

Prior to the Fed's decision, Bank of America surveyed current homeowners and prospective homebuyers about their attitudes and preferences.

According to Richard Krisinski, Bank of America market leader, there may already be a sense that the housing market is cooling off, but more than a third of New Jerseyans (37%) said so far this has not affected whether they still want to buy a home, or where.

One in five (20%) respondents said they would like to purchase a home in Bergen County, within shouting distance of New York City. That percentage was trailed by Monmouth (18%) and Essex (14%) counties.

"It's no coincidence that they also are three of the top six most populated counties, but New Jersey is a very dynamic state, with 21 counties offering really every measure of enjoyment and fun," Krisinski said.

The survey directly compared New Jersey respondents to their national counterparts, and Krisinski said most of the percentages were in range.

For instance, 66% of New Jerseyans said they would be willing to make an offer within three days of viewing a home (versus 65% nationally), with 23% saying they would not have a problem making an offer immediately (20% nationally).

Slightly fewer prospective homebuyers in the Garden State (37%) want to stick to the original timeline they set for themselves when buying a home than those across the country (41%).

"The statistics are very consistent regarding New Jersey versus the national indicators," Krisinski said.

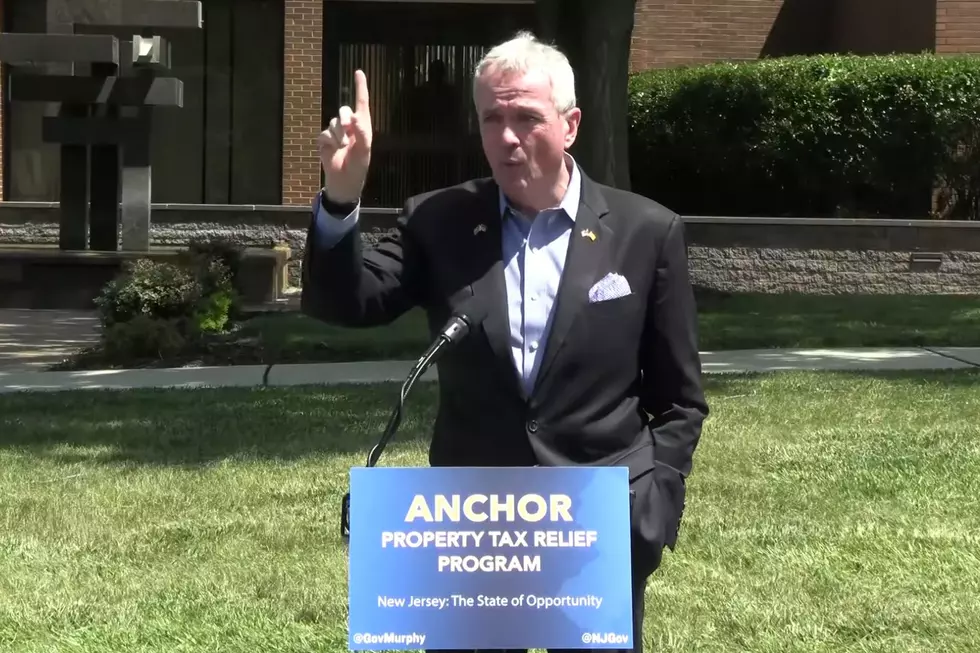

Those who hope to purchase homes in New Jersey are already aware it is a high-tax, high cost of living state, according to Krisinski, and it weighs on their decision.

Nearly two-thirds (65%) in the state admitted they are taking state and local property taxes into consideration.

"That's an indicator, clearly, that financial plans, the goals, the journey that individuals are considering, is specifically impacted by both state and local taxes," Krisinski said.

Yet even with tax concerns, New Jerseyans are not willing to compromise in certain areas: They are less likely than the national average to want to give up their privacy (34% vs. 46% nationally) or their self-care routines (22% vs. 26%).

Other tradeoffs were closer percentage-wise between the Garden State and the rest of the country, including the size of a home and its amount of livable space.

"What is apparent is the compromise that, generally speaking, prospective homebuyers, based on our polling, would allow for the neighborhood they're going to live in, how close they are to entertainment, restaurants, and shopping," Krisinski said.

Millennials had their own distinct opinions when it came to what they want from the homebuying experience, and that forms the second part of our report, coming Tuesday.

Patrick Lavery is a reporter and anchor for New Jersey 101.5. You can reach him at patrick.lavery@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.

9 things New Jersey would rather ban than plastic bags

A look inside Alicia Keys’ mansion

Every NJ city and town's municipal tax bill, ranked

More From 92.7 WOBM