If you have kids you may be getting extra money from the government

If you have have any children age 17 or younger, you might want to take a look at your bank account.

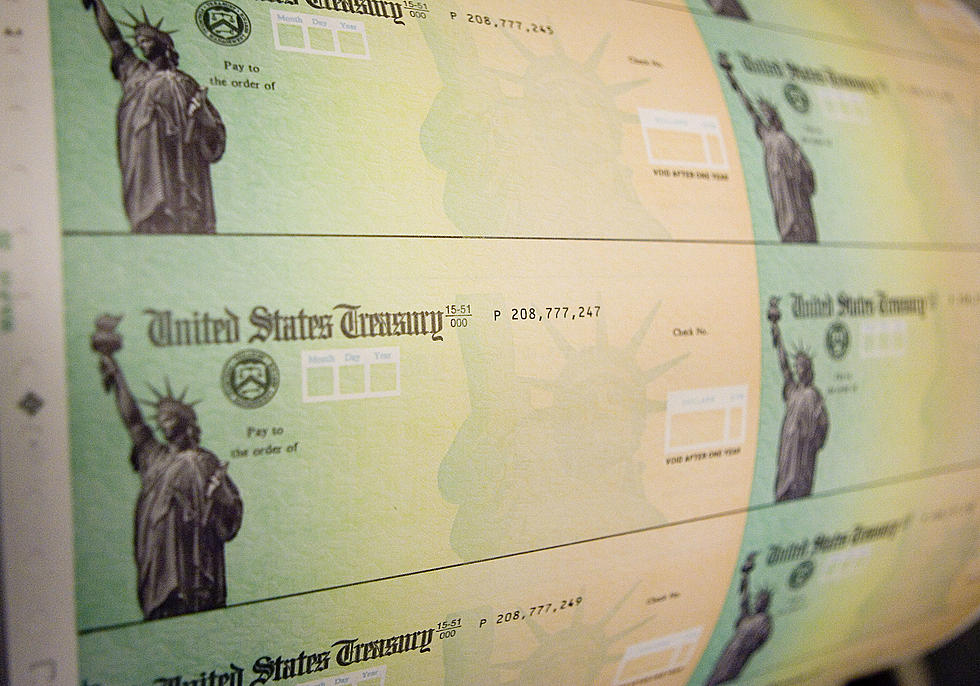

On Thursday, the Internal Revenue Service started making the first of six monthly payments to eligible families under the expanded child tax credit, which Congress approved as part of the American Rescue Plan earlier this year.

How much money families receive depends on the ages of the children they have in their household. For children under the age of six, the total credit increased from $2,000 to $3,600 per child. For those between the ages of 6 and 17, the total credit expanded to $3,000 per child, a $1,000 increase.

Families should expect to receive, per month, checks totaling between $250 to $300 per child.

According to Ralph Thomas, the CEO and executive director of the New Jersey Society of Certified Public Accountants, the eligibility for the tax credit is dependent on income, pointing out it’s available to taxpayers “with a modified adjusted gross income of $75,000 or less for singles, and $150,000 or less for married couples filing a joint return.”

Thomas said if a family files taxes electronically and qualifies for the credit, the IRS is sending that family half of the total amount of their eligible credit total in six monthly direct deposit installments. For those that don't file electronically, a check will be mailed.

The tax credit expansion, according to Thomas, is designed to help struggling families, but it’s important to remember the extra money you receive is based on your salary that is reflected in your 2020 or 2019 tax returns. That means that some families getting the credit could have to pay the government back.

“There could be a situation where if you’ve had a significant increase (in salary) and you go above the threshold for the different categories, that you would have to repay,” Thomas said.

He noted the tax credit expansion money is not considered taxable income, so it will not be taxed when you file your taxes next year.

Thomas said it’s also important to remember “there are individuals who do not file a tax return but they’re still eligible for the credit, they’re significantly below the (income) threshold where you have to file a tax return.”

He said in those instances the individual would need to go onto the IRS website and apply.

The expanded tax credit program is set to expire after one year but the Biden administration wants to extend it until at least 2025, or simply make it permanent.

According to the White House, the U.S. Department of Treasury estimates that $15 billion was distributed on July 15, impacting tens of millions of working families.

You can contact reporter David Matthau at David.Matthau@townsquaremedia.com.