Bigger tax relief likely amid ‘unprecedented’ NJ revenue surge

TRENTON – State tax collections are growing at an unprecedented rate, and a portion of the windfall appears likely to be used to provide more direct tax relief to residents.

Revenue forecasts for the balance of the current year and the approaching 2023 budget were updated Monday. Gov. Phil Murphy’s administration says revenues over the two years will be $7.8 billion more than it expected in March – even more than the $6.9 billion increase anticipated by analysts for the nonpartisan Office of Legislative Services.

“The state’s fiscal picture is remarkably strong,” said Deputy State Treasurer Aaron Binder. “The rapid revenue recovery last year followed by the continued revenue surge this year is unprecedented in New Jersey’s modern budget history.”

State revenues dipped slightly to $38 billion in fiscal 2020, the year the pandemic began. They grew to $44.3 billion in 2021 and are now forecast to reach $51.4 billion this year – up 35% in two years.

Binder delivered the update at a Senate Budget and Appropriations Committee hearing because state Treasurer Elizabeth Maher Muoio is still recovering from a COVID-19 infection.

“The administration hopes to work with the Legislature to ensure that any future investments we make together are directly wisely where they are needed most, including property tax relief beyond what we proposed in March,” Binder said.

The extra revenue pushes the projected surplus for June 2023 to nearly $12 billion.

Tax credits, tax cuts

Sen. Paul Sarlo, D-Bergen, says the state should use some of the money to provide a surplus of $7 billion to $8 billion – “after some capital investments, some enhanced tax credits. Tax cuts, potentially.”

Binder said the administration has no specific surplus target in mind but that even before current increases in revenues being seen around the country, states had surpluses average 18% of spending. That would be $8.8 billion.

“We think that with the resources coming in, as large a surplus as possible as well as paying down debt and looking at additional property tax relief is really the areas that we would recommend focusing on,” Binder said.

Even before Binder spoke, Assembly Speaker Craig Coughlin, D-Middlesex, issued a statement promising more help to residents.

“We have additional money this year, and New Jersey needs tax relief now," Coughlin said. "In this year’s budget, I will insist on the largest tax relief program in state history."

Assembly Minority Leader John DiMaio, R-Warren said that relief should come in the form of a tax cut if it's meant to be lasting.

“A tax relief program paid for by tax revenue is not real tax relief," DiMaio said. "It is a short-term big-government gimmick that is like putting gauze over a permanent wound instead of a Band-Aid.”

Three tanks of gas

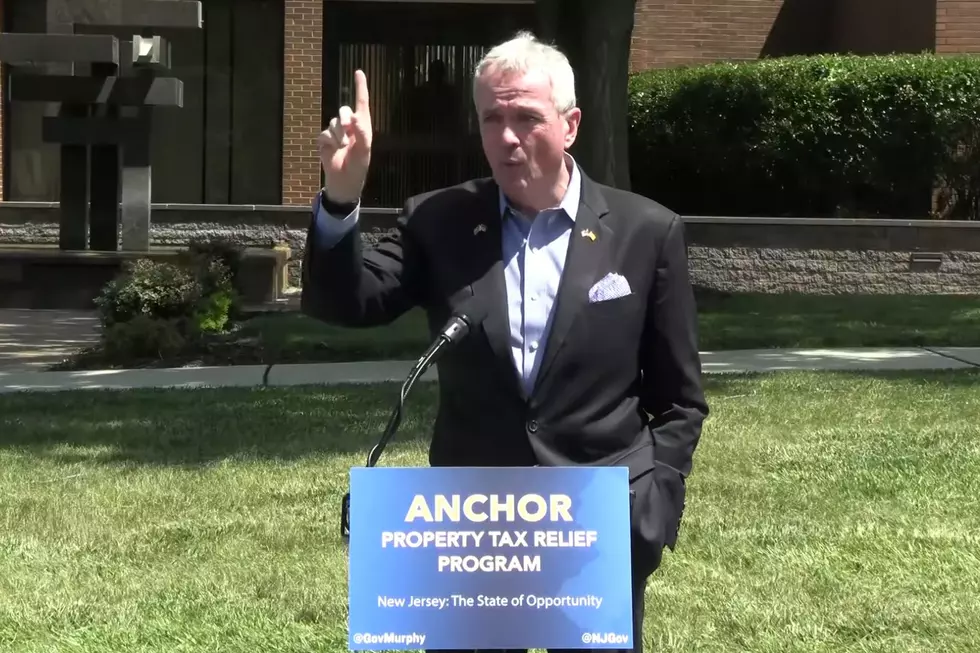

Last summer, the state mailed families $500 ‘middle class tax rebate’ checks, as part of the deal that hiked income taxes on millionaires. So, some critics of Murphy are unimpressed with proposed ANCHOR property tax rebates that would average $700 in the year ahead.

Sen. Mike Testa, R-Cumberland, said the rebates wouldn’t be much of a bump for most people and suggested that a one-time check of $1,500 would be “real money.”

“I mean at the present time $250 is approximately maybe, you know, three tanks of gas in the state of New Jersey,” Testa said. “I think this is an absolute paltry sum.”

Deputy Treasurer Aaron Binder says the administration wants to cooperate on what to do with the projected surplus. The ANCHOR program is projected to reach $1,150 in average benefits after three years, but Binder said it could be phased in faster.

“The administration is absolutely open to discussions on how we phase in ANCHOR,” Binder said.

Warning signs ahead

Binder and the Office of Legislative Services cautioned that the budget boom isn’t likely to last.

Next year’s forecast of $50.6 billion in revenue is down 1.6% from the revised total for this year.

“We agree that current growth rates are not sustainable,” Binder said. “Some revenues have peaked and should adjust back to more sustainable levels. We are assuming economic growth will continue but revenue growth will right-size after the current fiscal bubble.”

Sales tax revenues are expected to grow 2% in fiscal 2023, but the Murphy administration projects there will be drops in collections of income taxes, corporate taxes, inheritance taxes and taxes from real-estate sales.

“We are being very careful with next year’s forecast,” said Martin Poethke, director of the New Jersey Office of Revenue and Economic Analysis. “There’s certainly a consensus among forecasters around the country that we’re in an unusual period and that these growth rates are not sustainable.”

David Drescher, chief of the Legislature’s Revenue, Finance and Appropriations Section, said OLS believes “this is mostly a one-time effect.”

“In light of the dive in stock markets since the start of this year, we should not expect this kind of revenue gain to continue,” Drescher said.

Michael Symons is the Statehouse bureau chief for New Jersey 101.5. You can reach him at michael.symons@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.

2021 NJ property taxes: See how your town compares

New Jersey's smallest towns by population

More From 92.7 WOBM